SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| KIMCO REALTY CORPORATION | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

| NOTICE OF ANNUAL MEETINGOF STOCKHOLDERS |

Dear Stockholder:

We cordially invite you to attend the 20182020 annual stockholders’ meeting of Kimco Realty Corporation, a Maryland corporation (the “Company”).

| date: | April | |

| 28, 2020 | ||

| time: | 10:00 a.m. (local time) | |

| place: | Online only at: | |

| www.virtualshareholdermeeting.com/KIM2020 | ||

| record date: | The close of business on |

At the 20182020 annual meeting, stockholders as of the close of business on the record date will be asked to consider and vote upon the following matters, as more fully described in the Proxy Statement:

| 1 | 2 | 3 | 4 | 2 | 3 | 4 | 5 | ||||

Election of nine directors to serve for a term ending at the 2019 annual meeting of stockholders and until their successors are duly elected and qualify | Advisory resolution to approve the Company’s executive compensation (“Say-on-Pay”) as described in the Proxy Statement | Ratification of the appointment of Pricewaterhouse Coopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2018 | Such other business as may properly come before the meeting or any postponement(s) or adjournment(s) thereof | ||||||||

Election of eight directors to serve for a term ending at the 2021 annual meeting of stockholders and until their successors are duly elected and qualify | Advisory resolution to approve the Company’s executive compensation (“Say-on-Pay”) as described in the Proxy Statement | Ratification of the appointment of Pricewaterhouse Coopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2020 | Approval of the Company’s 2020 Equity Participation Plan | Such other business as may properly come before the meeting or any postponement(s) or adjournment(s) thereof | |||||||

All stockholders are cordially invited to attend the 2020 annual meeting, which will be conducted via a live webcast. The Company is excited to embrace the environmentally-friendly virtual meeting format, which it believes will enable increased stockholder attendance and participation. During this virtual meeting, you may ask questions and will be able to vote your shares electronically. You may also submit questions in advance of the 2020 annual meeting by visitingwww.virtualshareholdermeeting.com/KIM2020. The Company will respond to as many inquiries at the 2020 annual meeting as time allows.

If you plan to attend the 2020 annual meeting online, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. The 2020 annual meeting will begin promptly at 10:00 a.m. (Eastern Time). Online check-in will begin at 9:30 a.m. (Eastern Time), and you should allow ample time for the online check-in procedures.

YOUR VOTE IS IMPORTANT TO US.Whether or not you plan to attend the annual meeting, please authorize a proxy to vote your shares as soon as possible to ensure that your shares will be represented at the 20182020 annual meeting.

By Order of the Board of Directors,

Bruce M. Rubenstein

Executive Vice President, General Counsel and Secretary

March 18, 2020

|

Important Notice Regarding Internet Availability of Proxy Materials |

We are pleased to take advantage of the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet. We believe that this e-proxy process will expedite stockholders’ receipt of proxy materials, lower the costs and reduce the environmental impact of our |

|

| TABLE OF CONTENTS | |||

The following executive summary is intended to provide a broad overview of the items that you will find elsewhere in this Proxy Statement. As this is only a summary, we encourage you to read the entire Proxy Statement for more information about these topics prior to voting.

| Annual Meeting of | PROPOSAL | BOARD’S VOTING RECOMMENDATION | PAGE REFERENCES (for more detail) | |||

date: time: place: record date: | April 10:00 a.m. (local time) Online only at: The close of businesswww.virtualshareholdermeeting. com/KIM2020 on March 4, 2020 | Election of Directors | FOR EACH NOMINEE | 17 | ||

| Advisory Resolution to Approve Executive Compensation | FOR | 53 | ||||

| Ratification of Independent Accountants | FOR | 55 | ||||

| FOR | 56 | |||||

| PARTICIPATE IN THE ANNUAL MEETING |

Due to the potential travel and community gathering impacts of the coronavirus outbreak (COVID-19), the Company is moving to an online format for the 2020 annual meeting. You can access the virtual annual meeting at the meeting time atwww.virtualshareholdermeeting.com/KIM2020. By hosting the 2020 annual meeting online, the Company is able to communicate more effectively with its stockholders, enable increased attendance and participation from locations around the world, reduce costs and increase overall safety for both the Company and its stockholders. This approach also aligns with the Company’s broader sustainability goals. The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting.

If you plan to attend the 2020 annual meeting online, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. The 2020 annual meeting will begin promptly at 10:00 a.m. (Eastern Time). Online check-in will begin at 9:30 a.m. (Eastern Time), and you should allow ample time for the online check-in procedures.

6Kimco Realty Corporation 20182020 PROXY STATEMENT

| DIRECTOR NOMINEES(PROPOSAL 1) |

| Committee | Experience | |||||||||||||

|  |  |  |  |  |  |  |  |  |  |  | |||

| Milton Cooper | 89 | 1991 |  |  |  |  |  |  | ||||||

| Philip E. Coviello | 74 | 2008 |  |  |  |  |  |  |  |  |  | |||

| Richard G. Dooley | 88 | 1991 |  |  |  |  |  |  |  |  |  | |||

| Conor C. Flynn | 37 | 2016 |  |  |  |  |  | |||||||

| Joe Grills | 82 | 1997 |  |  |  |  |  |  |  |  |  | |||

| Frank Lourenso | 77 | 1991 |  |  |  |  |  |  |  |  |  | |||

| Colombe M. Nicholas | 73 | 2011 |  |  |  |  |  |  |  |  |  | |||

| Mary Hogan Preusse | 49 | 2017 |  |  |  |  |  |  |  |  | ||||

| Richard B. Saltzman | 61 | 2003 |  |  |  |  |  |  |  |  | ||||

We are requesting that the stockholders elect the nominees for director listed below to serve until the 2021 annual meeting of stockholders and until their successors are duly elected and qualify. The Board of Directors recommends a vote FOR each nominee.

| Committee | Experience | |||||||||||||

|  |  |  |  |  |  |  |  |  |  |  | |||

| Milton Cooper | 91 | 1991 |  |  |  |  |  |  | ||||||

| Philip E. Coviello | 76 | 2008 |  |  |  |  |  |  |  |  |  | |||

| Conor C. Flynn | 39 | 2016 |  |  |  |  |  | |||||||

| Frank Lourenso | 79 | 1991 |  |  |  |  |  |  |  |  |  | |||

| Colombe M. Nicholas | 75 | 2011 |  |  |  |  |  |  |  |  |  | |||

| Mary Hogan Preusse | 51 | 2017 |  |  |  |  |  |  |  |  | ||||

| Valerie Richardson | 61 | 2018 |  |  |  |  |  |  |  |  |  |  | ||

| Richard B. Saltzman | 63 | 2003 |  |  |  |  |  |  |  |  |  | |||

| Member |  |  |

|

Attendance:During 2017,2019, each director nominee attended 100% of the aggregate of the total meetings of the Board and of the committees of the Board on which such director serves. Ms. Hogan Preusseserved. Mr. Saltzman attended 100% of all Board andaudit committee meetings after her electionhis appointment to the Boardcommittee in February 2017.May of 2019.

Kimco Realty Corporation 20182020 PROXY STATEMENT7

| BOARDCOMPOSITION |

The following charts show the composition of the nine members of the Boardeight director nominees by age, tenure and gender. More information about our process for evaluating the composition of the Board and the role of diversity in recommending candidates for a director position can be found on page 26.

| Age | Tenure | Gender | ||

|   |   |

| CORPORATE GOVERNANCEHIGHLIGHTS |

INDEPENDENCE

We have an Executive Compensation Committee that is 100% independent. The Executive Compensation Committee engages its own compensation consultant and affirms each year that the consultant has no conflicts of interest and is independent.

NO HEDGING OR PLEDGING TRANSACTIONS

We have a policy prohibiting all directors and named executive officers (“NEOs”) from engaging in any hedging transactions with respect to equity securities of the Company held by them, which includes the purchase of any financial instrument (including prepaid variable forward contracts, equity swaps, and collars) designed to hedge or offset any decrease in the market value of our equity securities. We also have a policy that prohibits directors and NEOs from using the Company’s Common Stock in any pledging transactions.

COMPENSATION CLAWBACK POLICY

We may seek repayment of cash and equity incentive compensation paid to NEOs in the event of a material misstatement of the Company’s financial results where an NEO engaged in actual fraud or willful unlawful misconduct that materially contributed to the need to restate the Company’s financial results.

We have stock ownership guidelines for our directors and executive officers. As of December 31,

requirement. Ms. Hogan Preusse becameIn January 2019, the Executive Compensation Committee approved a director ofstock retention requirement for non-employee directors and executive officers who have not achieved the Company on February 1, 2017 and has until February 1, 2022 to meet her required ownership levels under our currentapplicable stock ownership guidelines.level. See page 23 for a detailed discussion of our stock ownership guidelines.

CHANGE OF CONTROL PAYMENTSEXECUTIVE SEVERANCE PLAN

We maintain an executive severance plan with a “double trigger” change in control arrangement that covers certain of our NEOs. The executive severance plan does not provide for any gross-up payments for taxes.

STOCKHOLDER ENGAGEMENT

The Board of Directors believes that accountability to stockholders is a mark of good corporate governance and is critical to the Company’s success. The Company regularly communicates with its stockholders throughout the year to better understand their views on a range of topics and to provide perspective on the Company’s corporate governance policies and practices.

During 2017,2019, the Company met with more than halfapproximately 42% of ourits top 2550 stockholders (representing approximately 43%39% of the outstanding shares of our Common Stock). Topics discussed included our strategy and performance, board composition and structure, executive compensation program and sustainability initiatives. We solicited feedback from stockholders on these subjects and reportedshared their responses towith our Board of Directors.

8Kimco Realty Corporation 20182020 PROXY STATEMENT

We are requesting that the stockholders approve, on a non-binding, advisory basis, the compensation of the NEOs as described in this Proxy Statement. The Board of Directors recommends a vote FOR Proposal 2 as it believes that the 2017 compensation decisions are consistent with key objectives of Kimco’s executive compensation program: to promote long-term performance through emphasis on the individual performances and achievements of our executive officers, commensurate with our business results, and to successfully execute our strategy to be the premier owner and operator of open-air shopping centers through investments primarily in the U.S. This proposal was supported by over 94% of the votes cast (which excludes abstentions and broker non-votes) in 2017 and 2016. Please see the Compensation Discussion and Analysis, Summary Compensation Table and other compensation tables and disclosures beginning on page 30 of this Proxy Statement for a full discussion of our executive compensation.

|

|

|

| |

The increase in U.S. pro-rata cash-basis rental rate leasing spreads represents the difference between new rent and prior rent for the same spaces on all renewals, options, or new leases executed during 2017, subject to certain exclusions. Total pro-rata occupancy refers to our proportional ownership percentage being applied against properties in which we own less than a 100% interest.

| ||

* Estimated full year 2018 dividend based on quarterly dividend paid January 16, 2018.

| ||

The table below summarizes the 2017 total compensation paid to each NEO (see pages 30 through 49 of this Proxy Statement for further detail).

| NAME | SALARY ($) | STOCK AWARDS ($) | NON-EQUITY INCENTIVE PLAN COMPENSATION ($) | ALL OTHER COMPENSATION ($) | TOTAL ($) |

| Milton Cooper | 750,000 | 1,341,158 | 976,000 | 27,395 | 3,094,553 |

| Conor C. Flynn | 1,000,000 | 2,387,507 | 2,135,000 | 41,284 | 5,563,791 |

| Ross Cooper* | 450,000 | 487,278 | 500,000 | 21,030 | 1,458,308 |

| Glenn G. Cohen | 675,000 | 1,337,000 | 793,000 | 24,094 | 2,829,094 |

| David Jamieson* | 425,000 | 487,278 | 500,000 | 17,443 | 1,429,721 |

*Ross Cooper and David Jamieson became executive officers as of February 27, 2017.

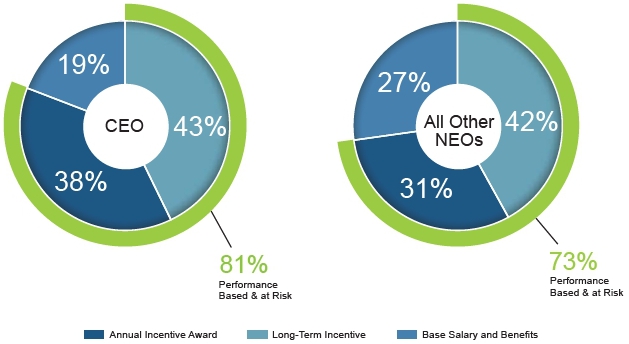

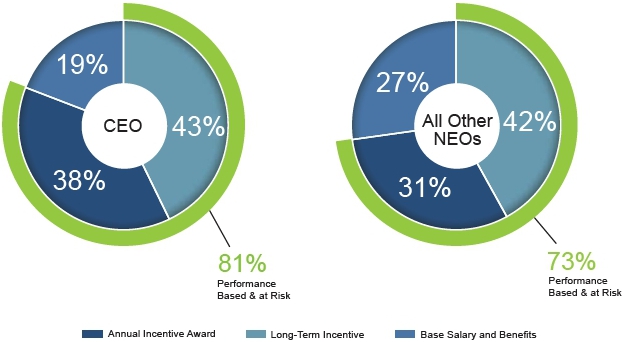

Consistent with our executive compensation program, the significant majority of the total compensation during 2017 for our CEO, Mr. Flynn, and all other NEOs was incentive-based, commensurate with business results, and at risk unless such business results were achieved, as illustrated below. See page 33 for a discussion of the components of our executive compensation program.

* Amounts are based on the Summary Compensation Table on page41.

Kimco Realty Corporation 2018 PROXY STATEMENT 11

| BEST PRACTICECORPORATE GOVERNANCE FEATURES |

WHAT WE DO

| WHAT WE DO |

✓DO maintain majority voting for the election of directors |

✓DO provide for annual election of |

✓DO align pay and performance |

✓DO deliver a substantial portion of the value of equity awards in performance shares—if our total stockholder return for a performance period is less than the minimum |

✓DO maintain rigorous stock ownership guidelines for directors and NEOs |

✓DO maintain a clawback policy |

✓DO conduct annual assessments of compensation at risk |

✓DO provide stockholders the right to amend the Bylaws |

✓DO have an Executive Compensation Committee comprised solely of independent directors |

✓DO retain an independent compensation consultant that reports directly to the Executive Compensation Committee and performs no other services for the Company |

✓DO provide caps |

✓DO provide continuing education for our Board |

✓DO have an annual offsite strategic review by the Board with management |

WHAT WE DON’T DO

| WHAT WE DON’T DO |

✗NO compensation or incentives that encourage |

✗NO tax |

✗NO “single-trigger” change in control cash or equity payments |

✗NO re-pricing or buyouts of underwater stock options |

✗NO hedging or pledging transactions involving our securities |

✗NO guarantees of cash incentive compensation or of equity grants |

✗NO |

✗NO supermajority voting requirements |

✗NO stockholder rights plan |

12 Kimco Realty Corporation 20182020 PROXY STATEMENT9

We are requesting that the stockholders approve, on a non-binding, advisory basis, the compensation of the NEOs as described in this Proxy Statement. The Board of Directors recommends a vote FOR Proposal 2 as it believes that the 2019 compensation decisions are consistent with key objectives of Kimco’s executive compensation program: to promote long-term performance through emphasis on the individual performances and achievements of our executive officers, commensurate with our business results, and to successfully execute our strategy to be the premier owner and operator of open-air and mixed-use shopping centers in the U.S. This proposal was supported by over 89% of the votes cast (which excludes abstentions and broker non-votes) in 2019. Please see the Compensation Discussion and Analysis, Summary Compensation Table for 2019 and other compensation tables and disclosures beginning on page 30 of this Proxy Statement for a full discussion of our executive compensation.

| 2019 PERFORMANCEHIGHLIGHTS |

| $340.0M | +49.8% | +3.0% | |||

NET INCOME AVAILABLE | ANNUAL TOTAL SHAREHOLDER RETURN INCLUDING THE REINVESTMENT OF DIVIDENDS | INCREASE IN SAME | |||

| +7.8M SF | +7.9% | +60 | Basis Points | ||

TOTAL PRO-RATA | U.S. PRO-RATA CASH- | INCREASE IN TOTAL | |||

See Annex A starting on page 65 for the definition of same property NOI and a reconciliation of net income available to the Company’s common shareholders to same property NOI. The increase in U.S. pro-rata cash-basis rental rate leasing spreads represents the difference between new rent and prior rent for the same spaces on all renewals, options, or new leases executed during 2019, subject to certain exclusions. Total pro-rata occupancy refers to our proportional ownership percentage being applied against properties in which we own less than a 100% interest.

10Kimco Realty Corporation2020 PROXY STATEMENT

| 2019 fiscal year highlights, bring the Company’s 2020 Vision, into focus: |

| 2019 HIGHLIGHTS: ●Achieved an all-time high, total pro-rata occupancy of 96.4% as of December 31, 2019. This represented a 60-basis point increase from the 2018 year-end level. Pro-rata anchor occupancy for the Company also reached a record high of 98.9%, representing an increase of 150 basis points from the 2018 year-end level. ●Executed 1,265 leases totaling over 7.7 million square feet in 2019 and increased the Company’s pro rata annual base rent per square foot by 4%. Achieved pro-rata rental rate leasing spreads of 7.9% with rental rates for the new leases up 20.8% and renewals / options increasing 5.4%. ●Disposed of ownership interests in 32 properties and five land parcels totaling 4.8 million square feet for an aggregate gross sales price of $593.3 million. The Company’s share was $426.0 million. The dispositions completed in 2019 mark the end of the Company’s major disposition program. The Company also acquired three grocery-anchored parcels and increased its ownership interest in one existing property for a total of $34.0 million. | |

| 2019 HIGHLIGHTS: ●Produced net income available to the Company’s common shareholders of $340.0 million, or $0.80 per diluted share, for the year ended December 31, 2019 compared to $439.6 million, or $1.02 per diluted share, for the year ended December 31, 2018. ●Achieved funds from operations available to the Company’s common shareholders (“FFO”) as adjusted (non-GAAP) of $1.47 per diluted share for the full year 2019, representing a 1.4% increase from 2018 FFO as adjusted of $1.45 per diluted share. ●Generated a 3.0% increase in same property NOI for the year ended December 31, 2019. ●Produced total shareholder return, including dividend reinvestment, for the year 2019 of 49.8%. ●Generated net proceeds of $200.1 million through the issuance of 9.5 million shares of common stock at a weighted average net price of $21.03 per share under the Company’s ATM (At The Market) continuous offering program. ●Redeemed $175.0 million of 6.000% Class I, $175 million of 5.625% Class K and $225.0 million of 5.500% Class J Cumulative Redeemable Preferred Stock during the year 2019, improving the Company’s Net Debt and Preferred to EBITDA, as adjusted. ●Issued $350.0 million of 3.700% notes maturing October 2049, with an effective yield of 3.765%. As of December 31, 2019, the Company maintains one of the longest debt maturity profiles in the REIT industry at 10.6 years. | |

| 2019 HIGHLIGHTS: ●Completed Mills Station, the Signature SeriesTMground-up development located in Owings Mills, MD. Additionally, completed 22 redevelopment projects during 2019, including the residential tower at Pentagon Centre located across the street from Amazon’s planned HQ2. The 22 projects totaled $312.2 million with a blended return of 7.6%. ●Obtained entitlements for future mixed-use projects. As of December 31, 2019, the Company has over 4,500 entitlements for apartment units, over 800 for hotel keys and over 1.2 million square feet for office space. |

Kimco Realty Corporation2020 PROXY STATEMENT11

| 2019 COMPENSATIONAWARDED |

The table below summarizes the total compensation awarded to each NEO (see pages 30 through 49 of this Proxy Statement for further detail) with respect to 2019.

| NAME | SALARY ($) | STOCK AWARDS ($) | NON-EQUITY INCENTIVE PLAN COMPENSATION ($) | ALL OTHER COMPENSATION ($) | TOTAL ($) |

| Milton Cooper | 750,000 | 1,818,654 | 1,214,720 | 23,462 | 3,806,836 |

| Conor C. Flynn | 1,000,000 | 3,250,511 | 2,657,200 | 40,856 | 6,948,567 |

| Ross Cooper | 575,000 | 2,015,499 | 911,040 | 23,308 | 3,524,847 |

| Glenn G. Cohen | 675,000 | 1,798,812 | 986,960 | 23,901 | 3,484,673 |

| David Jamieson | 550,000 | 2,015,531 | 911,040 | 19,324 | 3,495,895 |

| SIGNIFICANT PORTION OF PAY IS PERFORMANCE-BASED& AT RISK* |

Consistent with our executive compensation program, the significant majority of the total compensation awarded with respect to 2019 for our CEO, Mr. Flynn, and all other NEOs was performance-based, commensurate with business results, and “at risk” unless such business results were achieved, as illustrated below. See page 33 for a discussion of the components of our executive compensation program.

* Amounts are based on the Summary Compensation Table on page 41.

12Kimco Realty Corporation2020 PROXY STATEMENT

| ENVIRONMENTAL, SOCIAL AND |

The Company is focused on building a thriving and sustainableviable business, one that succeeds by delivering long-term value for our stockholders. We take pride in how we conduct ourThe Company’s Environmental, Social and Governance (“ESG”) program is aligned with its core business including the positive contributions we makestrategy of creating destinations for everyday living that inspire a sense of community and deliver value to our communitiesmany stakeholders. David Jamieson, the Company’s Executive Vice President and Chief Operating Officer, is responsible for overseeing the implementation of program initiatives on a daily basis, and Conor Flynn, the Company’s CEO, receives monthly updates on program progress and oversees the implementation of all enterprise initiatives in this area. The individual component of each of Mr. Jamieson’s and Mr. Flynn’s 2019 annual bonus includes an assessment of his individual contributions towards the ESG program.

In 2019, the Company established an ESG Steering Committee, a cross-functional and diverse committee comprised of employee representatives throughout the Company to plan and coordinate the execution of the ESG program. The ESG Steering Committee meets on a monthly basis and is responsible for recommending strategic priorities and goals to Executive Management and the Board of Directors on a quarterly basis. The Executive Compensation Committee is responsible to review and monitor (i) the development and implementation of goals established for the ESG program, (ii) the development of metrics to gauge progress toward the achievement of those goals, and (iii) the Company’s progress against those goals. The four pillars of our initiativesESG program are:

| ● | Embrace the Future of Retail:Foster a sense of place at our shopping centers, creating people-centered properties that are more convenient and accessible |

| ● | Engage Our Local Communities:Make a positive impact and be known in the communities where we operate and live |

| ● | Lead in Operations and Resiliency:Maximize efficiency of operations and protect our assets from disruption including by climate and security-related disruptions |

| ● | Foster an Engaged, Inclusive and Ethical Team:Cultivate high levels of employee satisfaction and improve diversity of management |

During 2019, the Company was recognized for its commitment to safeguard the environment. Our key corporate responsibility priorities include openly engaging key stakeholders, leading by example in our operations, positively influencing our tenants and partners and enhancing our communities. In addition, during 2017 we invested approximately $11 million in sustainable improvement projects, including LED lighting retrofits, gateway lighting controls, utility sub-metering and irrigation controls.

ESG principles. The Company is committed to providing regular reporting on its corporate responsibility efforts, including both quantitative and qualitative information about impacts and initiatives. Since 2011,was cited by the Company has responded annually to both the Carbon Disclosure Project (“CDP”) and Global Real Estate Sustainability Benchmark (“GRESB”), and each year,earning the distinguished Green Star designation for a sixth consecutive year. In addition, the Company has increased its relative standingwas included in scoring published by both CDP and GRESB.the Dow Jones Sustainability Index for the fifth consecutive year. In addition to these annual investor responses,2019, the Company annually publisheswas named for the first time to the Russell “FTSE4Good” Index Series, received one of the leading ESG scores for the real estate industry from Institutional Investor Services (ISS) and was presented with the NAREIT Leader in the Light Award, a comprehensive Corporate Responsibility Report, basedtop honor among the Company’s peers. Additionally, in 2019, the Company received its second consecutive “Great Place to Work” certification honoring the culture it provides to employees on a daily basis. We promote a true “open door” environment in which all feedback and suggestions are welcome. We conduct regular interactive training, so employees have clarity with respect to our values and the Global Reporting Initiative framework, in ordertype of company we are. Through third-party, anonymous survey tools, we poll our associates regularly to reachlearn how we can be even better, and a broad audiencenumber of stakeholders.our programs today are a result of the valuable input they’ve offered.

ESG Disclosure Roadmap |  |  |  | ||||||||||

|

|

|

| ||||||||||

| |||||||||||||

2017 LIGHTING ENERGY EFFICIENCYIN PARKING CAMPAIGNAmong companies participating in this campaign in 2017, we were recognized for:

|

Summarizes ESG program priorities and material risk disclosures. |  | Proxy Statement Summarizes corporate governance practices, including how the Board and management are engaged in ESG program strategy, governance and accountability. |  | Corporate Responsibility Report Based on the Global Reporting Initiative (GRI) standard, summarizes environmental and social performance. | ||||

| |||||||||

| |||||||||

Kimco Realty Corporation 20182020 PROXY STATEMENT13

| RATIFICATION OFINDEPENDENT ACCOUNTANTS (PROPOSAL 3) |

We are requesting that the stockholders ratify the appointment of the Company’s independent registered public accounting firm for the year ending December 31, 2018.2020. The Board of Directors recommends a vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2018.2020.

| TYPE OF FEES | 2017 | 2016 |

| Audit Fees(1) | $1,872,801 | $1,821,865 |

| Audit-Related Fees | - | - |

| Tax Fees | - | - |

| All Other Fees(2) | - | $1,955 |

| Total | $1,872,801 | $1,823,820 |

| TYPE OF FEES | 2019 | 2018 |

| Audit Fees(1) | $1,826,532 | $1,689,988 |

| Audit-Related Fees(2) | $550,000 | - |

| Tax Fees | - | - |

| All Other Fees(3) | $2,700 | $2,700 |

| Total | $2,379,232 | $1,692,688 |

(1)Audit fees include all fees for services in connection with (i) the annual integrated audit of the Company’s fiscal 20172019 and 20162018 financial statements and internal control over financial reporting included in its annual reports on Form 10-K, (ii) the review of the financial statements included in the Company’s quarterly reports on Form 10-Q, (iii) as applicable, the consents and other required letters issued in connection with debt and equity offerings and the filing of the Company’s shelf registration statement, current reports on Form 8-K and proxy statements during 20172019 and 2016,2018, (iv) ongoing consultations regarding accounting for new transactions and pronouncements and (v) out of pocket expenses.

(2)Audit-Related Fees consisted of fees billed for audit procedures relating to the implementation of the Company’s new operating and accounting software system.

(3)All other fees consisted of fees billed for other products and services. The fees relate to a publication subscription service and software licensing for accounting and professional standards.

| APPROVAL OF THE 2020EQUITY PARTICIPATION PLAN (PROPOSAL 4) |

We are requesting that the stockholders approve the adoption of the Kimco Realty Corporation 2020 Equity Participation Plan (the “2020 Plan”), which is a successor to the Restated Kimco Realty Corporation 2010 Equity Participation Plan (the “Existing Plan” or the “2010 Equity Participation Plan”). The Board of Directors approved the 2020 Plan on March 10, 2020, subject to stockholder approval.

The Board of Directors recommends a vote FOR the approval of the adoption of the 2020 Plan, as it believes that an employee equity compensation program is a necessary and powerful incentive and retention tool that benefits all stockholders.

The Existing Plan expired in March 2020. Accordingly, unless the 2020 Plan is approved, we will not be able to continue making equity compensation grants to our employees, consultants and non-employee directors.

| HIGHLIGHTS OF THE 2020EQUITY PARTICIPATION PLAN PROPOSED AMENDMENTS |

14Kimco Realty Corporation 20182020 PROXY STATEMENT

| PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERSto be held on April |

We are providing you with this Proxy Statement in connection with the solicitation of proxies to be exercised at the 20182020 Annual Meeting of Stockholders (the “Meeting”) of Kimco Realty Corporation, a Maryland corporation. The Meeting will be heldDue to the potential travel and community gathering impacts of the coronavirus outbreak (COVID-19), the Company is moving to an online format for the 2020 annual meeting. You can access the virtual annual meeting at the Grand Hyatt New York, 109 East 42nd Street, New York, NY 10017,meeting time atwww.virtualshareholdermeeting.com/KIM2020. By hosting the 2020 annual meeting online, the Company is able to communicate more effectively with its stockholders, enable increased attendance and participation from locations around the world, reduce costs and increase overall safety for both the Company and its stockholders. This approach also aligns with the Company’s broader sustainability goals. The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting. If you plan to attend the 2020 annual meeting online, you will need the 16-digit control number included in your Notice, on Tuesday, April 24, 2018,your proxy card or on the instructions that accompany your proxy materials. The 2020 annual meeting will begin promptly at 10:00 a.m. (local time)(Eastern Time). Online check-in will begin at 9:30 a.m. (Eastern Time), and you should allow ample time for the purposes set forth in the Notice of Annual Meeting of Stockholders.online check-in procedures. This Proxy Statement contains important information regarding the Meeting, the proposals on which you are being asked to consider and vote upon, information you may find useful in determining how to vote, and information about voting procedures. As used in this Proxy Statement, “we,” “us,” “our,” “Kimco” or the “Company” refers to Kimco Realty Corporation, a Maryland corporation.

This solicitation is made by the Company on behalf of the Board of Directors of the Company (the “Board of Directors” or the “Board”). Costs of this solicitation will be borne by the Company. Directors, officers, employees and agents of the Company and its affiliates may also solicit proxies by telephone, fax, e-mail or personal interview. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by

them in sending proxy materials to stockholders. The Company will pay fees of approximately $10,500$12,000 to Alliance Advisors, L.L.C. for soliciting proxies on behalf of the Company.

Holders of our common stock, par value $0.01 per share (“Common Stock”), at the close of business on February 28, 2018,March 4, 2020, the record date, may (virtually) attend and vote at the Meeting. We refer to the holders of our Common Stock as “stockholders” throughout

If you received your proxy materials by mail, you should have received a proxy card enclosed with the Proxy Statement. Stockholders can vote in person (virtually) at the Meeting or by authorizing a proxy. There are three ways to authorize a proxy to vote your shares:

BY TELEPHONE- Stockholders located in the United States thatwho received proxy materials by mail can authorize a proxy by telephone by calling 1-800-690-6903 and following the instructions on the enclosed proxy card;

BY INTERNET- Stockholders can authorize a proxy over the Internet at www.proxyvote.com by following the instructions on the enclosed proxy card or Notice of Internet Availability (as defined on the next page); or

BY MAIL- Stockholders thatwho received proxy materials by mail can authorize a proxy by mail by signing, dating and mailing the enclosed proxy card.

Telephone and Internet authorization methods for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. (local time) on April 23, 2018.27, 2020.

| VOTINGINSTRUCTIONS |

to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person (virtually) at the Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and bring it to the Meeting in order to vote.

Kimco Realty Corporation 2020 PROXY STATEMENT15

If you authorize a proxy to vote your shares, the individuals named on the proxy card or authorized by you by telephone or Internet (your “proxies”) will vote your shares in the manner you indicate. If you sign and return the proxy card or authorize your proxies by telephone or Internet without indicating your instructions, your shares will be voted as follows:

FORthe election of all nominees for director (see Proposal 1);FORthe resolution to approve, on a non-binding, advisory basis, the Company’s executive compensation (see Proposal 2);FORthe ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2018the year ending December 31, 2020 (see Proposal 3);FORthe approval of the adoption of the 2020 Plan (see Proposal 4); and in the discretion of the proxy holder on any other matter that may properly come before the Meeting.

To be voted, proxies must be filed with the Secretary of the Company prior to the Meeting. Proxies may be revoked at any time before exercise at the Meeting (i) by filing a notice of such revocation with the Secretary of the Company, (ii) by filing a later-dated proxy with the Secretary of the Company or (iii) by voting in person (virtually) at the Meeting.

Kimco Realty Corporation 2018 PROXY STATEMENT 15

Table of Contents Virtual attendance at the Meeting alone will not be sufficient to revoke a previously authorized proxy.

If you own shares through a broker or other nominee in street name, you may instruct your broker or other nominee as to how to vote your shares. A “broker non-vote” occurs when you fail to provide a broker or other nominee with voting instructions and a broker or other nominee does not have the discretionary authority to vote your shares on a particular matter because the matter is not a routine matter under the New York Stock Exchange (“NYSE”) rules. Broker non-votes and abstentions will be counted for purposes of calculating whether a quorum is present at the Meeting. The vote required for each proposal is listed below:

| PROPOSAL | VOTE REQUIRED | BROKER DISCRETIONARY VOTING ALLOWED | |

| PROPOSAL 1 | Election of | Majority of the votes cast with respect to a nominee | No |

| PROPOSAL 2 | Resolution to approve, on a non-binding, advisory basis, the Company’s executive compensation | Majority of the votes cast on the Proposal | No |

| PROPOSAL 3 | Ratification of the appointment of the Company’s auditor for | Majority of the votes cast on the Proposal | Yes |

| PROPOSAL 4 | Approval of the adoption of the 2020 Equity Participation Plan | Majority of the votes cast on the Proposal | No |

With respect to Proposal 1, you may vote FOR, AGAINST or ABSTAIN for each nominee. If you ABSTAIN from voting on Proposal 1, the abstention will have no effect because it will not be a vote cast. The nominees receiving a majority of the votes cast will be elected as directors (i.e.(i.e., the number of votes cast for a nominee must exceed the number of votes against that nominee).

With respect to Proposals 2, 3 and 3,4, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on Proposal 2 or Proposal 3, the abstention will have no effect because it will not be a vote cast. However, because stockholder approval of the 2020 Plan is required under NYSE rules and because the NYSE treats abstentions as votes cast, if you ABSTAIN from voting on Proposal 4, the abstention will have the effect of a vote against such proposal.

The U.S. Securities and Exchange Commission’s rules permit us to deliver a single Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) or single set of Meeting materials to one address shared by two or more of our stockholders. We have delivered only one Notice of Internet Availability, Proxy Statement or annual report, as applicable,

to multiple stockholders who share an address, unless we received contrary instructions from any of the impacted stockholders prior to the mailing date. We will promptly deliver, upon written or oral request, a separate copy of the Notice of Internet Availability, Proxy Statement or annual report, as applicable, to any stockholder at a shared address to which a single copy of those documents was delivered. In the future, if you prefer to receive separate copies of the Notice of Internet Availability, Proxy Statement or annual report, as applicable, contact Broadridge Financial Solutions, Inc. at 1-866-540-7095 or in writing at 51 Mercedes Way, Edgewood, NY 11717, Attention: Householding Department. If you are currently a stockholder sharing an address with another stockholder and are receiving more than one Notice of Internet Availability, Proxy Statement or annual report, as applicable, and wish to receive only one copy of future Notices of Internet Availability, proxy statements or annual reports, as applicable, for your household, please contact Broadridge at the above phone number or address.

16Kimco Realty Corporation 20182020 PROXY STATEMENT

| PROPOSAL 1 ELECTION OF DIRECTORS |

The Company’s Bylaws (the “Bylaws”), provide that all directors be elected at each annual meeting of stockholders. Our Board of Directors is currently comprised of nine directors.eight directors, all of which are standing for election at the Meeting. If authorized, and unless otherwise noted by the authorizing stockholder, the persons named as proxies in the accompanying form of proxy intend to vote in favor of the election of each of the nineeight nominees for director designated below, with each to serve until the next annual meeting of stockholders and until their respective successors are duly elected and qualify. It is expected that each of these recommended nominees will be able to serve, but if any such nominee is unable to serve, the proxies may vote for another person recommended by the Nominating and Corporate Governance Committee and nominated by the Board of Directors or the Board of Directors may reduce the number of directors to be elected at the Meeting.

| INFORMATIONREGARDING NOMINEES |

The members of our Board of Directors provide the Board with a broad combination of experience and backgrounds that enable the Board to lead and advise Kimco on its most crucial matters. Each of our directors has a distinguished record of leadership positions and decades of experience exercising responsible, prudent judgment in highly competitive businesses. We believe that each of our Board members offers broadcomprehensive, strategic insights into Kimco’s competitive position based on their individual backgrounds enabling them to provide input on central issues of strategy and to oversee its execution by management. This includes directors with longstanding institutional experience with Kimco and in the REIT industryand retail industries as well as directors who have joined our Board more recently and who bring new perspectives. The members of our Board individually have a proven record of collaboration in successfully implementing business practices, and the Board collectively represents a diversity of intellectual and experiential backgrounds, with complementary skills and professional training.

| MILTON COOPER |

Milton Cooper is the Executive Chairman of the Board of Directors forof the Company. Mr. Cooper served as the Chairman of the Board of Directors and CEO of the Company from November 1991 to December 2009. In addition, Mr. Cooper was Director and President of the Company for more than five years prior to November 1991. In 1960, Mr. Cooper, along with a partner, founded the Company’s predecessor. Mr. Cooper led the Company through its initial public offering and growth over the past five decades. In addition, Mr. Cooper received a National Association of Real Estate Investment Trusts (“NAREIT”) Industry Leadership Award for his significant and lasting contributions to the REIT industry. Mr. Cooper is also a Director at Getty Realty Corporation. Mr. Cooper graduatedholds degrees from City College in New York and Brooklyn Law School.

Key experience and qualifications to serve on the Board of Directors include: | ||||||||||||||||||||||||||||||||||||||||||

| ● | Mr. Cooper co-founded the Company and helps maintain the Company’s continuing commitment to its core values of integrity, creativity and stability. Mr. Cooper’s service on the Board of Directors allows the Company to preserve its distinctive culture and history. |

| ● | Mr. Cooper’s reputation within the NAREIT community and among the Company’s business partners contributes significantly to the Company’s continued leadership in the REIT industry. |

| ● | Mr. Cooper’s ability to communicate, encourage and foster diverse discussions of the Company’s business, together with his five decades of executive leadership experience, make Mr. Cooper a highly effective Executive Chairman of the Board of Directors. |

Kimco Realty Corporation 20182020 PROXY STATEMENT17

| PHILIP E. COVIELLO |

Philip E. Coviello has been a Director of the Company since May 2008, is2008. Mr. Coviello serves as the Chair of the Audit Committee and as a member of the Executive Compensation and Nominating and Corporate Governance Committees. Mr. Coviello was a partner at Latham & Watkins LLP, an international law firm, until his retirement from that firm in 2003. In addition, since 1996, Mr. Coviello has been a Director of Getty Realty Corporation, where he serves as Chair of the Audit Committee and is a member of its Compensation and Nominating/Corporate Governance and Nominating Committees. Mr. Coviello holds an A.B. from Princeton University, an L.L.B. from the Columbia University School of Law and an M.B.A. from the Columbia University School of Business.

Key experience and qualifications to serve on the Board of Directors include:

| ● | 35 years of experience counseling boards of directors and senior management as a corporate lawyer on a wide range of corporate governance, regulatory compliance and other issues that affect public companies. |

| ● | Decades of experience as both issuers’ and underwriters’ counsel in capital markets transactions and heavy involvement in the presentation and analysis of hundreds of audited financial statements, pro forma financial statements and SEC filings, including representing the Company in its initial public offering. |

| ● | Mr. Coviello’s contributions to the Company’s Audit Committee are bolstered by his service as Chair of the Audit Committee of Getty Realty Corporation. |

|

|

Richard G. Dooley has been a Director of the Company since December 1991. Mr. Dooley currently serves as the Lead Independent Director, the Chair of the Nominating and Corporate Governance Committee and a member of the Audit and Executive Compensation Committees. From 1993 to 2003, Mr. Dooley was a consultant to, and from 1978 to 1993 served as the Executive Vice President and Chief Investment Officer of, the Massachusetts Mutual Life Insurance Company. Mr. Dooley is a Director, Chair of the Compensation Committee and member of the Audit and Corporate Governance Committees of Jefferies LLC (formerly Jefferies Group, Inc.), a subsidiary of Leucadia National Corporation (“Leucadia”) (NYSE: LUK) pursuant to a merger between Leucadia and Jefferies Group, Inc. effective March 1, 2013. Mr. Dooley formerly served as a Director and member of the Compensation Committee of Leucadia. Mr. Dooley holds a B.S. degree from Northeastern University and an M.B.A. from the Wharton School of the University of Pennsylvania.

18 Kimco Realty Corporation 2018 PROXY STATEMENT

| CONOR C. FLYNN |

Conor C. Flynn has been the CEO of the Company since January 2016. Mr. Flynn joined the Company in 2003 as an asset manager and has held a variety of senior leadership roles with the organization including President, Chief Operating Officer, Chief Investment Officer and President, Western Region. Mr. Flynn receivedholds a B.A. degree from Yale University and a Master’s degree in Real Estate Development from Columbia University. Mr. Flynn is a licensed real estate broker in California, and a member of NAREIT, the Real Estate Roundtable, the Urban Land Institute (“ULI”) and the International Council of Shopping Centers (“ICSC”).

Key experience and qualifications to serve on the Board of Directors include:

| ● | Mr. Flynn’s leadership roles during his |

| ● | Mr. Flynn’s role as Chief Executive Officer, together with his broad leadership experience and successful team-building efforts at the Company, provide unique insights into strategic and operational issues that the Company faces. |

| ● | Mr. Flynn’s extensive operational background, together with his vision and demonstrated leadership results, aligns with the Company’s long-term objectives to |

|

| today through the redevelopment of assets to their highest and best use, in major metropolitan markets. |

Joe Grills has been a Director of the Company since January 1997 and is the Chair of the Executive Compensation Committee and a member of the Audit and Nominating and Corporate Governance Committees. Mr. Grills was employed by IBM from 1961 to 1993 and held various positions in financial management in both IBM’s domestic and international businesses. Mr. Grills served as a director (1994-2007) and Co-Chairman of the Board of Directors (2002-2007) of a cluster of BlackRock (Merrill Lynch) Mutual Funds. He was a Director, was Vice Chairman (2000-2006), was Chairman (2006-2011) and is currently Chairman Emeritus of the Montpelier Foundation. He was on the Investment Advisory Committee of the Virginia Retirement System (1998-2016) and previously served as Vice Chairman (2002-2005) and Chairman (2005-2009). Mr. Grills was a Trustee, was Chairman and is currently a member of the Investment Committee of the Woodberry Forest School. In addition, Mr. Grills is a Trustee and is currently a Member (Chairman 2007-2011; 2014-2015) of the Investment Committee of the National Trust for Historic Preservation (also on Finance and Trustee/Governance Committees) and is a Trustee, a member of the Audit Committee and Chairman of the Development Committee of National Main Street Center, Inc., a subsidiary of National Trust for Historic Preservation. Mr. Grills was on the Individual Investor Advisory Committee of the NYSE from 2001 to 2014. He is a former Chairman and member of the Committee on Investment of Employee Benefit Assets of the Association of Financial Professionals. Mr. Grills holds a B.A. from Duke University and an M.B.A. from the University of Chicago.

18Kimco Realty Corporation 20182020 PROXY STATEMENT19

| FRANK LOURENSO |

Frank Lourenso has been a Director of the Company since December 1991. Mr. Lourenso is currentlyserves as the Chair of the Executive Compensation Committee and as a member of the Audit Executive Compensation and Nominating and Corporate Governance Committees. Mr. Lourenso was an Executive Vice President of JPMorgan Chase & Co. (“J.P. Morgan,” and successor by merger to The Chase Manhattan Bank and Chemical Bank, N.A.) from 1990 until his retirement in June 2013. Mr. Lourenso was a Senior Vice President of J.P. Morgan for more than five years prior to 1990. Mr. Lourenso holds a B.B.A. and an M.B.A. from Baruch College.

| ● | Executive Vice President of J.P. Morgan, one of the world’s leading financial services firms with global scale and reach, bringing to the Board of Directors the perspective of a financial executive with exposure to a wide array of economic, social and corporate governance issues. |

| ● | Extensive experience with capital markets matters in the real estate industry and a key contributor to the Board of Directors’ strategic liquidity and capital discussions. |

| ● | Expertise in management oversight and financial matters relating to complex global organizations. |

| COLOMBE M. NICHOLAS |

Colombe M. Nicholas has been a Director of the Company since May 2011. Ms. Nicholas is currently a member of the Executive Compensation and Nominating and Corporate Governance Committees. From 2002 to January 2018, Ms. Nicholas served as a consultant to Financo Global Consulting, the international consulting division of Financo, Inc., where she focused on identifying expansion opportunities and providing growth advice to companies. Ms. Nicholas’ retail experience includes Bonwit Teller, Bloomingdale’s and R.H. Macy. From the 1980s to 2000, Ms. Nicholas has served as President and CEO of Anne Klein Group, President and CEO of the Orr Felt Company, President and Chief Operating OfficerCOO of Giorgio Armani Fashion Corporation and President and CEO of Christian Dior New York. While at Christian Dior New York, Ms. Nicholas led sales growth from $125 million to $425 million. Ms. Nicholas has previously served on the Board of Directors of Oakley, Inc., The Mills Corporation, Tandy Brands and Herbalife International.Ltd. Ms. Nicholas hasholds a B.A. from the University of Dayton, a J.D. from the University of Cincinnati College of Law and an honorary doctorate in business administration from Bryant College of Rhode Island.

| ● | Over 15 years of experience in the retail industry in various executive positions provides familiarity and a broad understanding of the operation of retail shopping centers. |

| ● | Experience as President and CEO at major licensing, apparel and accessory manufacturing corporations provides insight into management’s day to day actions and responsibilities related to sales of those products. |

| ● | Experience through service on other public company boards of directors and knowledge of corporate governance best practices in |

20 Kimco Realty Corporation 20182020 PROXY STATEMENT19

| MARY HOGAN PREUSSE |

Mary Hogan Preusse has been a Director of the Company since February 2017. Ms. Hogan Preusse is currently serves as the Lead Independent Director, the Chair of the Nominating and Corporate Governance Committee and a member of the Audit and Executive Compensation and Nominating and Corporate Governance Committees. Ms. Hogan Preusse retired from APG Asset Management US Inc., a leading manager of pension assets, in May 2017. She joined APG’s predecessor in 2000 as a senior portfolio analyst and portfolio manager, and served from January 2008 to May 2017 as Managing Director and co-head of Americas Real Estate for APG Asset Management US Inc. She also served on the Executive Board of APG Asset Management US Inc. from 2008 until 2017. Prior to joining APG, Ms. Hogan Preusse spent eight years as a sell-side analyst covering the REIT sector and began her career at Merrill Lynch as an investment banking analyst. Ms. Hogan Preusse currently serves on the boards of directors of Digital Realty Trust, Inc., Host Hotels & Resorts, Inc. and VEREIT, Inc. In May 2017, Ms. Hogan Preusse founded Sturgis Partners LLC, which provides consulting, investment and advisory services related to the public (listed) real estate industry. In 2015, she was the recipient of NAREIT’s E. Lawrence Miller Industry Achievement Award for her contributions to the REIT industry. She is also a member of the International Council of Shopping Centers and serves on the Investor Advisory Council and the Dividends Through Diversity and Inclusion Initiative’s Steering Committee for NAREIT, and is a member of the Real Estate Advisory Board for the Carey Business School at Johns Hopkins University. Ms.NAREIT.Ms. Hogan Preusse graduatedholds an A.B. in Mathematics from Bowdoin College in Brunswick, Maine with a degree in Mathematics and has served as a member of Bowdoin’s Board of Trustees since 2012.

| ● | Significant experience in the REIT industry, including over 25 years of REIT financial statement analysis and underwriting and as a frequent panelist and speaker at industry conferences. |

| ● | Experience managing all of APG’s public real estate investments in North and South America, with approximately $13 billion in assets under management at the time of her announced departure from APG. |

| ● | Extensive experience interfacing with management and directors of |

| VALERIE RICHARDSON |

Valerie Richardson has been a Director of the Company since June 2018. Ms. Richardson is currently a member of the Audit, Executive Compensation and Nominating and Corporate Governance Committees. Ms. Richardson is the Vice President of Real Estate for The Container Store, Inc. Prior to joining The Container Store in the fall of 2000, Ms. Richardson was Senior Vice President – Real Estate and Development for Ann Taylor, Inc., the specialty women’s apparel retailer, where she administered the company’s store expansion strategy for Ann Taylor and Ann Taylor Loft. Before Ann Taylor, Ms. Richardson was Vice President of Real Estate and Development of Barnes & Noble, Inc., the country’s largest bookselling retailer. Prior to Barnes & Noble, Ms. Richardson was a Partner in the Shopping Center Division of the Dallas-based developer, Trammell Crow Company. Since 2004, she has been a member of the Board of Trustees of the International Council of Shopping Centers (ICSC”). She was elected ICSC Chairman for the 2018-2019 term as the first Chairman associated with a retail company. Ms. Richardson previously served on the Board of the ICSC Foundation from 2011 to 2019. Ms. Richardson served as a Trustee at Baylor Scott & White Medical Center – Plano from 2010 to 2016. Ms. Richardson holds an M.B.A. in Real Estate from the University of North Texas and a B.S. in Education from Texas State University.

| ● | Over 35 years of experience in the retail industry in various executive positions provides familiarity and a broad understanding of the operation of retail shopping centers, retail operations and real estate strategy. |

| ● | Involvement in and leadership of the ICSC, a 65,000+ member, professional trade association, provides experience and prospective on industry best practices and public and private retailer and real estate company performance both domestically and internationally. |

| ● | Experience through service as a trustee and head of the Quality Committee at Baylor & White Medical Center – Plano provides corporate governance knowledge and extensive time interfacing with management and directors. |

20Kimco Realty Corporation2020 PROXY STATEMENT

| RICHARD B. SALTZMAN |

Richard B. Saltzman has been a Director of the Company since July 2003. Mr. Saltzman is a member of the Audit, Executive Compensation and Nominating and Corporate Governance Committees. Mr. Saltzman currently serves as Chairman of the Board of Colony Credit Real Estate Inc. (NYSE: CLNC) and previously served as a director, President and Chief Executive Officer of Colony NorthStar,Capital, Inc. (NYSE: CLNS), is Chairman of the Board of NorthStar Realty Europe Corp. (NYSE: NRE) and Chairman of the Board of Colony NorthStar Credit Real Estate Inc. (NYSE: CLNC).CLNY) from 2015 to 2018. Prior to joining various predecessors of Colony NorthStarCapital in 2003, Mr. Saltzman spent 24 years in the investment banking business, most recently as a Managing Director and Vice Chairman of Merrill Lynch’s investment banking division. Mr. Saltzman hasholds a B.A. from Swarthmore College and an M.S. from Carnegie-MellonCarnegie Mellon University. Mr. Saltzman previously served on the board of directors of Colony Capital, Inc. until its merger to form Colony NorthStar in January 2017.

| ● | More than |

| ● | Significant experience with REITs, including initial public offerings, other capital markets products and mergers and acquisitions. |

| ● | More than 30 years of direct experience interacting in various capacities with the Company. |

VOTE REQUIRED

Nominees for director shall be elected by a majority of the votes cast in person (virtually) or by proxy at the Meeting. A majority of the votes cast means the affirmative vote of a majority of the total votes cast “for” and “against” such nominee. For purposes of the election of directors, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote.

THE BOARD OF DIRECTORS OF THE COMPANYUNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES SET FORTH IN THIS PROXY STATEMENT.

Kimco Realty Corporation 20182020 PROXY STATEMENT21

| GENERAL INFORMATIONABOUT THE BOARD OF DIRECTORS |

TERM OF OFFICE

All directors of the Company elected at the Meeting will serve terms ending at the 20192021 annual meeting of stockholders and until their respective successors are duly elected and qualify.

ATTENDANCE AT BOARD OF DIRECTORS, COMMITTEE MEETINGS AND 20172019 ANNUAL MEETING.

The Board of Directors met fivesix times in person or telephonically in 2017.2019. During 2017,2019, each director nominee attended 100% of the aggregate of the total meetings of the Board and of the committees of the Board on which such director serves. Ms. Hogan Preusseperson served. Mr. Saltzman attended 100% of all Board andthe audit committee meetings after her electionhis appointment to the Boardcommittee in February 2017.May of 2019. The Company encourages directors to attend each annual meeting of stockholders, and all of the directors were in attendance at the 20172019 Annual Meeting of Stockholders held on April 25, 2017.30, 2019. Our director attendance policy is included in our Corporate Governance Guidelines, which are available on the Company’s website located at www.kimcorealty.com and are available in print to any stockholder who requests them.

COMMUNICATIONS WITH DIRECTORS

The Audit Committee and the non-management directors welcome anyone who has a concern about the Company’s conduct or policies, or any employee who has a concern about the Company’s accounting, internal accounting controls or auditing matters, to communicate that concern directly to the Board of Directors, the Lead Independent Director, the non-management directors or the Audit Committee. Such communications may be confidential or anonymous, and may be submitted in writing to the Board of Directors, the Lead Independent Director, the non-management directors or the Audit Committee by sending a letter by mail addressed to the Board of Directors, the Lead Independent Director, the non-management directors or the Chair of the Audit Committee, as applicable, c/o Secretary of the Company, Kimco Realty Corporation, 3333 New Hyde Park Road,500 North Broadway, Suite 100, New Hyde Park,201, Jericho, NY, 11042-0020.11753-2128. The Board of Directors has designated Richard G. Dooley as its Lead Independent Director to review these communications and present them to the entire Board of Directors or forward them to the appropriate directors. In addition, the Company maintains an Ethics Helpline, as further discussed in the Company’s Code of Conduct, which allows employees and contractors to submit concerns anonymously via phone or the Internet.

| DIRECTORINDEPENDENCE |

Our Board of Directors has adopted a formal set of categorical independence standards for directors. These categorical standards specify the criteria by which the independence of our directors will be determined, including guidelines for directors and their immediate families with respect to past employment or affiliation with the Company or its independent registered public accounting firm. These categorical standards meet, and in some areas exceed, the listing standards of the NYSE. The Board of Directors’ categorical standards are available along with our Corporate Governance Guidelines on the Company’s website located at www.kimcorealty.com and are available in print to any stockholder who requests them. In accordance with these categorical standards and the NYSE listing standards, the Board of Directors undertook its annual review of the independence of its directors on January 30, 2018.28, 2020. During this review, the Board of Directors considered transactions and relationships between each director or members of his or her immediate family and the Company. The Board of Directors also considered whether there were any transactions or relationships between directors or members of their immediate family (or any entity of which a director or an immediate family member is an executive officer, general partner or significant equity holder).

The purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the director is independent.

As a result of this review, the Board of Directors affirmatively determined that the following nominees for directordirectors are independent of the Company and its management under the standards set forth in the categorical standards and the NYSE listing standards:

| Philip E. Coviello | |

| Mary Hogan Preusse | |

| Valerie Richardson | |

| Colombe M. Nicholas | Richard B. Saltzman |

In making these determinations, the Board of Directors considered the relationships and transactions described under the caption “Certain Relationships and Related Transactions” beginning on page 50.

In addition, none of the independent directors’ family members serves as an executive officer, as defined by Rule 3b-7 under the Securities Exchange Act of 1934, as amended, of the Company.

22Kimco Realty Corporation 20182020 PROXY STATEMENT

| CORPORATEGOVERNANCE |

BOARD LEADERSHIP STRUCTURE

The Board of Directors has separated the roles of the Executive Chairman of the Board of Directors and the CEO in recognition of the differences between the two roles. The CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Executive Chairman of the Board of Directors provides guidance to the CEO, establishes the agenda for Board of Directors meetings in consultation with the CEO and presides over meetings of the full Board of Directors. Because Mr. Cooper, the Executive Chairman, is an employee of the Company and is, therefore, not “independent,” the Board of Directors has appointed the Chairman of the Nominating and Corporate Governance Committee, Richard G. Dooley,Mary Hogan Preusse, as Lead Independent Director to preside at all executive sessions of “non-management” directors, as defined under the NYSE Listed Company Manual.

LEAD INDEPENDENT DIRECTOR

The Lead Independent Director is elected by the other independent directors and presides at all meetings of the Board of Directors at which the Executive Chairman is not present, including executive sessions of the independent directors which typically occur after each in-person Board meeting. The Lead Independent Director encourages and facilitates active participation of all directors and serves as a liaison between management and the other independent directors. The Lead Independent Director also has the authority to call meetings of the independent directors, monitors and coordinates with management on corporate governance, environmental and social issues and developments, and approves meeting agendas and the information sent to the Board of Directors, including the quality, quantity and timeliness of such information.

STOCKHOLDER ENGAGEMENT

The Board of Directors believes that accountability to stockholders is a mark of good corporate governance and is critical to the Company’s success. The Company regularly communicates with its stockholders throughout the year to better understand their views on a range of topics and to provide perspective on the Company’s corporate governance policies and practices. In addition, the Company annually publishes a Corporate Responsibility Report to highlight and update the Company’s ESG practices.

During 2017,2019, the Company met with more than halfapproximately 42% of ourits top 2550 stockholders (representing approximately 43%39% of the outstanding shares of our Common Stock). Topics discussed included our strategy and performance, board composition and structure, executive compensation program and sustainability initiatives. We solicited feedback from stockholders on these subjects and reported their responses to our Board of Directors.

STOCK OWNERSHIP GUIDELINES

The Board of Directors adopted revised stock ownership guidelines in July 2012 for non-employee directors and executive officers that require each non-employee director and executive officer to own shares of our Common Stock.

Under the guidelines, all current non-employee directors and executive officers must own shares of our Common Stock with a value equal to five times the annual Board of Directors retainer. Executive officers must own shares of our Common Stock with a value equal

to a certain multiple of his or her annual Board of Directors retainer or base salary. Our Executive Chairman must own shares of our Common Stock with a value equalPlease refer to five times base salary; our CEO must own shares of our Common Stock with a value equal to five times base salary; our President must own shares of our Common Stock with a value equal to three times base salary; our Chief Operating Officer must own shares of our Common Stock with a value equal to three times base salary; and our Chief Financial Officer must own shares of our Common Stock with a value equal to two times base salary.the table below for the applicable multiple. Equity interests that count towards the satisfaction of the ownership guidelines include shares owned outright, shares jointly owned, restricted shares and shares held in a 401(k) retirement plan. Directors and executive officers have five years from the date they become a member of the Board of Directors or an executive officer to meet the ownership levels.

In January 2019, the Executive Compensation Committee approved a stock retention requirement for non-employee directors and executive officers. Non-employee directors and executive officers who have not achieved the applicable stock ownership threshold must hold all net-settled shares (after payment of withholding taxes, transaction costs and the exercise price for options, as applicable) until he or she meets the applicable stock ownership threshold. All of our directors and executive officers are currently in compliance with the stock ownership requirements, except for Ms. Hogan Preusse, who was elected to the Board of Directors on February 1, 2017 and has until February 1, 2022 to meet the required ownership levels.requirements.

| COVERED PERSON | MULTIPLE OF SALARY / RETAINER |

| Executive Chairman | 5x |

| Non-Employee Director | 5x |

| Chief Executive Officer | 5x |

| President | 3x |

| Chief Operating Officer | 3x |

| Chief Financial Officer | 2x |

DIRECTOR CONTINUING EDUCATION

The Company maintains a formal program of continuing education for directors. In 2017,2019, directors participated in customized Company-sponsored sessions on business-related topics, corporate governance matters, SEC rule changes, and other current topics such as ethical conduct and cyber security, including issues applicable to particular committees of the Board of Directors. These sessions included detailed presentations on these matters and discussions on each of the covered topics.

CLAWBACK POLICY

The Company may seek repayment of cash and equity incentive compensation paid to NEOs in the event of a material misstatement of the Company’s financial results where an NEO engaged in actual fraud or willful or unlawful misconduct that materially contributed to the need to restate. When the Executive Compensation Committee of the Board of Directors determines that these circumstances exist, the Executive Compensation Committee may direct the Company to recover the after-tax portion of the difference between the compensation actually paid or awarded and the compensation calculated using the restated financial statements, based upon the Executive Compensation Committee’s view of all relevant facts and circumstances and the best interests of the Company.

Kimco Realty Corporation 2020 PROXY STATEMENT23

RISK OVERSIGHT

Our Board of Directors oversees an enterprise-wide approach to risk management designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. Management is responsible for establishing our business strategy, identifying and assessing the related risks and establishing appropriate risk management practices. Our Board of Directors reviews our business strategy and management’s assessment of the related risk and discusses with management the appropriate level of risk for the Company.

Kimco Realty Corporation 2018 PROXY STATEMENT 23

Our Board of Directors administers its risk oversight function with respect to our operating risk as a whole and meets with management at least quarterly to receive updates with respect to our operations, business strategies and the monitoring of related risks. The Board of Directors also delegates oversight to the Audit, Executive Compensation and Nominating and Corporate Governance Committees to oversee selected elements of risk:

| ● | Our Audit Committee selects and engages our independent registered public accounting firm and oversees financial risk exposures, including monitoring the integrity of the financial statements, internal control over financial reporting and the independence of the auditor of the Company. The Audit Committee receives a risk and internal controls assessment report from the Company’s internal auditors on at least an annual basis and more frequently as appropriate, assists the Board of Directors in fulfilling its oversight responsibility with respect to compliance with legal and regulatory matters |

| related to the Company’s financial statements and meets quarterly with our financial management, independent auditors and legal advisors for updates on risks related to our financial reporting function. The Audit Committee also reviews and monitors our compliance programs, including the whistleblower program and whistleblower helpline with respect to financial reporting and other matters and oversees financial, credit and liquidity risk by working with our treasury function to evaluate elements of financial and credit risk |

and advise on our financial strategy, capital structure and long-term liquidity needs, and the implementation of risk mitigating strategies. Individuals who supervise day-to-day risk in this area have direct access to the Board of Directors, and our Chief Financial Officer meets regularly with our Audit Committee to discuss and advise on elements of risks related to our credit risk. The Audit Committee also oversees risk by working with management to review | |

| ● | Our Executive Compensation Committee oversees risk management by participating in the creation of compensation structures that create incentives to support an appropriate level of risk-taking behavior consistent with the Company’s business strategy and stockholder interests. |

| ● | Our Nominating and Corporate Governance Committee oversees governance related risks by working with management to establish corporate governance guidelines applicable to the Company, including recommendations regarding director nominees, the determination of director independence, Board of Directors leadership structure and membership on Board of Directors committees. |

Our Board of Directors and committees’ risk oversight responsibilities are discussed further in “Committees of the Board of Directors” below.

| COMMITTEESOF THE BOARD OF DIRECTORS |

The following table identifies the current committee chairs and members:

| AUDIT COMMITTEE | EXECUTIVE COMPENSATION COMMITTEE | NOMINATING & CORPORATE GOVERNANCE COMMITTEE | ||

| Independent Directors | Philip E. Coviello | C | ● | ● |

| Frank Lourenso | ● | ● | ||

| Colombe M. Nicholas | ● | ● | ||

| Mary Hogan Preusse | ● | ● | C | |

| Valerie Richardson | ● | ● | ● | |

| Richard B. Saltzman | ● | ● | ● | |

| Management Directors | Milton Cooper | |||

| Conor C. Flynn |

(C) Chair

24Kimco Realty Corporation 20182020 PROXY STATEMENT

| AUDIT COMMITTEE | |

Committee members: | Number of meetings in fiscal year 2019: 6 |

| Philip E. Coviello,Chair | |

| Frank Lourenso | |

| Mary Hogan Preusse | |

| |

| Richard B. Saltzman | |

Messrs. Coviello, Dooley, Grills and Lourenso and Ms.Saltzman and Mses. Hogan Preusse and Richardson are each an “audit committee financial expert,” as determined by the Board of Directors in accordance with Item 407(d)(5) of Regulation S-K, and Messrs. Coviello, Dooley, Grills and Lourenso and Ms.Saltzman and Mses. Hogan Preusse and Richardson are each “independent” from the Company as defined by the current listing standards of the NYSE.

The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the Audit Committee Charter is available on the Company’s website located at www.kimcorealty.com and is available in print to any stockholder who requests it.

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities as related to the Company’s risk management processes. The Board of Directors and Audit Committee oversee:

| ● | the integrity of the Company’s financial statements and financial reporting process and the Company’s systems of internal accounting and financial controls; |

| ● | the performance of the internal audit function; |

| ● | the annual independent integrated audit of the Company’s consolidated financial statements and internal control over financial reporting, including the engagement of the independent registered public accounting firm and the evaluation of the independent registered public accounting firm’s qualifications, independence and performance; |

| ● | policy standards and guidelines for risk assessment and risk |